Blockchain summit report: Day 1 - "Enterprise cloud"

- Imgur album: https://imgur.com/a/5ohhB

- Reddit: https://www.reddit.com/r/ethereum/comments/545ldk/blockchain_summit_report_day_1_enterprise_cloud/

- Devcon day 0

- Devcon day 1

- Devcon day 2

- Devcon day 3

- Blockchain summit - demo day

- Blockchain summit - Day 1

Event details

Today was day 1 of the 2 day "International Blockchain summit" presentations.

On every seat was a little bag that had 3 books about the Blockchain! Unfortunately they were all in Chinese.

Presentations summary

Whereas DEVCON2 was all about development, and leveraging the network effects of leveraging other projects in the ecosystem, the presentations today were VERY high level talks.

There was a massive stark difference between "the old guard" in the Fintech space, and the disruptors that are shaking things up.

Take a look at the BOC (Bank of China) and ChinaLedger presentations. They talk about how Distributed computing is dangerous. ChinaLedger go on to say that they need the power to be able to go in and halt transactions, modify smart contracts on the fly, liquidate accounts when they need. While also saying that they will make sure they will do everything to help privacy and use encryption… which only the Government can unlock ("Golden keys"?). It was the most centralised "Blockchain" I have ever heard of.

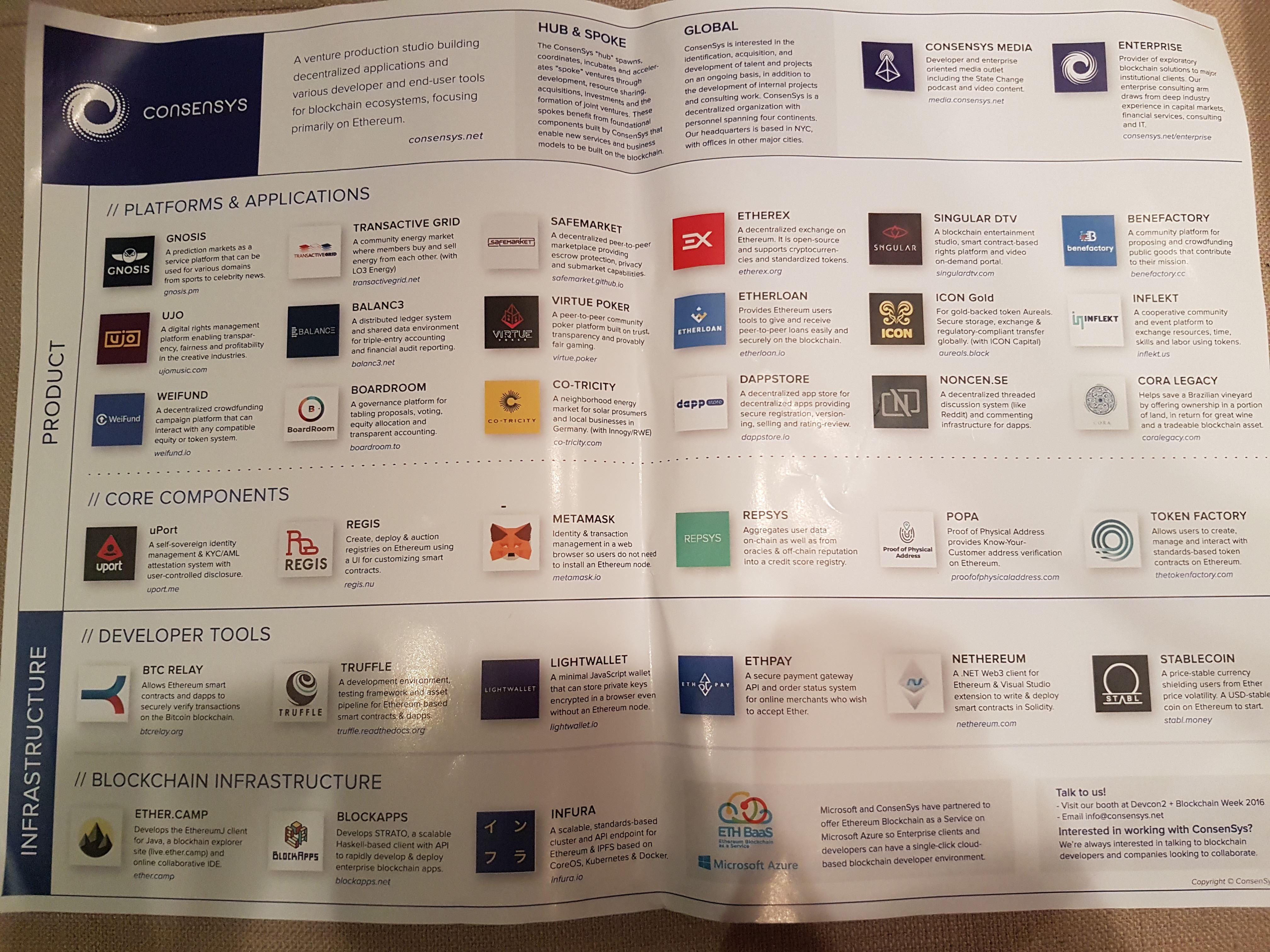

On the flip side I was inspired by the forward thinking of the Consensys presentation, and their long term vision for where to drive the Ethereum platform. They are helping to create open tools and platforms that will be leveragable by a multitude of projects (as demonstrated with Ujo and BHP project "Rai stones").

[caption id="attachment_media-8" align="alignnone" width="4032"] The Consensys ecosystem[/caption]

The Consensys ecosystem[/caption]

After the Consensys presentation, my 2nd favourite presentation was by Wanxiang labs "10 years to build a city", talking about how they plan on taking some land and creating from scratch a smart city powered by the blockchain and electric vehicles. While the other old guard are squabbling about how it is going to impact their "business as usual" profits, there were the new projects out there envisioning and disrupting.

The BHP presentation was also pretty cool, a great implemenation of using Blockchain to improve a business process.

Presentations

New Finance: Technical & Legal rules - BoC

He is from bank of China.

Entire presentation was him being scared and trying to justify why current Blockchain tech is an unregulated wasteland, and why there needs to be regulation from banks and government.

For Fintech they think Blockchain will not be successful without proper regulations

Blockchain finance - it is distributed.

Storing all of the transactions will take a lot of storage space. What to do once the transaction rates exceed what can be processed.

Thinks that public distributed transactions will not be more than a toy like with Bitcoin. For real FinTech they need something different for a high frequency.

Thinks that decentralisation should not be the core feature of Blockchains (due to transaction limit).

Thinks it should be decentralised, not distributed.

Should be done with private consortiums.

Needs legal rules and technical rules.

They think that self rulemaking currencies (Bitcoin) can not be regulated. So need to stop them, to prevent bad things like money laundering. This is showing the loopholes brought about by Bitcoin.

So when using digital currencies, they need certifications and tracking.

"We need more regulations and rules to facilitate the healthy development of this space. Only with support of regulations can new technology take off".

Me: I totally disagree… (if not already apparent)

Blockchain futures & realities - CSDC

China Securities Depository and clearinghouse

He was much more open minded and forward looking. Is a pep talk for "things are going to change", how are we going to use these new things. He said that he recorded it into English that should be able to be downloaded, would be worth watching if you are into this space.

Summary: Genie is out of the bottle, we need to embrace this and think how we are going to put the requirements of securities ("real name transactions") in a decentralised way. And the registration and tracking of assets to real names.

People have ideals because they are not happy with reality. Due to this dissatisfaction, people are passionate about trying to make that dream a reality.

Need to play by the rules, or the market will be chaos. So now we have facilities law, regulations, etc. This forms the framework of China economic. This is very different from Blockchain. This is at odds to the distributed systems.

Seems like we are dissatisfied with this, so trying to reconcile these differences.

All securities transactions need to follow "real name" transactions, but want to do this in a decentralised manner.

Market cap is 54 trillion (of something in China).

GDP is over 70 million

They are researching Blockchain, but not just in the lab. Need to find potential applications and use cases for it. If we want to implement Blockchain technologies, we need to see what the hurdles will be, so we can get closer to the ideal.

As BoC speaker said, the number of transactions per seconds is HUGE. Daily may reach 10s of millions at its peak. How are we going to handle this with a theoretical framework.

Need to start from the reality of China. And the reality is it is a giant country with a huge population, which depends on the capital market. If you just implement within a lab it is okay. But if it is going to be put into the industry, then we need to work with the government. We can't just get rid of the government, it is impossible (REVOLUTION!!). So need to focus on key senarios to tackle, as you can't just apply Blockchain everywhere simultaneously. Or all your efforts will fruitless.

How to complement it initially, not replace it.

Ten years efforts to build a city (Wanxiang Labs)

Me: I reallly liked this presentation. I've been keeping notes for months around building this type of innovative city in Australia. I plan on rewatching this one again later.

Going to build a city in 10 years. An energy gathering city in HangZhou 10KM2.

Their US company is starting to build new energy vehicle.

900m RMB? 90k people.

Deploy the city into the cloud. Intelligent life, traffic & services. Everything will be connected. IoT, Internet, smart living, smart transport.

Once this is successful, they plan on launching it across the world. Will publish their learnings.

Launching incubators and accelerators. Their own cloud Blockchain as a Service.

Many scenarios in this smart city that could utilise Blockchain. Distribution for Solar power. ID & Vehicle registration. Intelligent community services.

Can promote a sharing economy throughout the community.

Partnering with Microsoft, IBM, Consensys, Ethereum foundation, WeBank, AliCloud

Vitalik Buterin keynote

Talking of the progress China has made in Blockchain innovation in such a short period of time. He visited China 3 years ago and visited a number of Bitcoin companies and was impressed on the scale of what China had, much more than what was happening in USA.

But all the focus was just on cryptocurrencies, not Blockchain technologies, Just mining.

2nd time, he saw some kind of experimentation happening with interesting things (like coloured coins?)

3rd time saw more interest in Blockchains.

4th? time, he did a hackathon with Wanxiang labs (event sponsor), and there were ~30 projects. The growth since then has been rapidly growing. The scale of projects we couldn't have imagined 3 years ago. Was just theoretical, now a lot of ideas are almost reality. e.g. Self-sovereign identity, instant settlement.

Hyperledger

https://www.hyperledger.org/

Goals. Build an opensource dev focused community of communities to build a hyperledger based solution. Create a family of "etnerprise grade" open source blockchain framework, platform & libraries.

Because it is an enterprise opensource project, they need to track contributions, patent details, etc. Is part of the Linux Foundation, which has 16 years of providing governance stucture support for major open source projects.

80 project partners. IBM, Intel, Accenture, JP Morgan, Airbus, ANZ bank, Cisco, etc.

20 of the 80 project partners, are based in China. Apache license v2.

A world or many chains. There will not be only one blockchain. There will be many public chians and millions of private chains. Each may use different consensus mechanisms.

Major projects are:

Fabric: Developed by IBM. PBFT, moving to Raft and other pluggable consensus mechanisms. Written in Go.

Sawtooth Lake: Proof of Elapsed Time. Runs on secure enclaves. Written in Python.

Hyperledger explorer: GUI for navigating Fabric & swatooth lake.

Fabric-py SDK. (Java proposed later).

Future:

Smart contract engines. Portable identities.

Will never see a "HyperCoin". It is about making Hyperledger a standard, and a governance group.

IBM keynote - IBM Blockchain & Hyperledger

Today if you want to do something in your business on Blockchain it is difficult. Hard to scale, issues with privacy.

No Enterprise support.

Need tools to write tests for smart contracts. Need good solution patterns.

Difficult to scale up, especially around transaction rates.

Built Fabric to support "serious business"

Permissioned blockchains can't scale. Every node shouldn't execute every transaction.

The 2 peers that are interacting are the only ones that should execute.

IBM has implemented this internally to resolve invoice disputes with their suppliers.

IBM

All the slides were in Chinese. Difficult to follow unfortuantely.

The (original) Silk Road was important for trade. Blockchain may be just as important for trade in the future

People are debating the need of distributed systems being an important thing of Blockchains, is it really necessiary? Blockchain should instead be focused on unblocking instead.

IBM will provide an IBM certified docker container.

IBM Blockchain. http://www-31.ibm.com/ibm/cn/blockchain/index.html

Has a concept of a "shadow chain"?

Blockchain Platform @ Microsoft (Bletchley)

At Devcon1 Microsoft announced Blockchain as a Service. Rolled out DevTest Labs to allow you to spin up public, private, permissioned, and consotrium blockchians quickly. Provisoin with 1 click. Mix & match from best available blockchain tech.

Bletchley: Open infrastructure, Enterprise capabilities.

Microsoft is not building their own Blockchain.

Blockchain has some missing parts (identity, privacy, key management lifecycle, tools). Asked our partners what are the missing parts.

A database in itself isn't an application.

(re)Announcing: Bletchley v1.

2 parts. Distributed infrastructure layer (Blockapps, R3, bitpay, parity, Eris). There isn't going to be 1 Blockchain to rule them all, so allow you to leverage any of them.

Lots of customers were taking a long time trying to spin up private consortiums, and trying to secure them correctly. Used to take 3 weeks, now down to 8 questions and 5 minutes. Spins up a private Ethereum consortium. 4-100s of nodes.

Distributed middleware "fabric" layer. Tools that can work across many blockchain technologies.

Cryptlets are a way of doing offchain processing. Receive market data based on an event (market price daily closing, CRM event).

Need to have trusted execution of the logic, to attest that it was not tampered with.

Secure IP protected algorithms. Scale an algorithm for max performance by running it off blockchain in a secure & attested way in the cloud.

Oracles may be malicious, or they may be intercepted during transmission.

Cryptlets run on a secure host with a secure communication channel in a trust envelope.

Marketplace for publishing the cryptlets into a market for others to consume.

Azure cloud is twice the size of Amazon & Google COMBINED.

Bletchley Cryptlet Fabric. Supports Ethereum, will support more Blockchains. It is middleware that will support many.

Secure execution on demand. Standard way of publishing and accessing external resources.

BaaS roadmap.

DevTest labs, will continue to onboard more.

Bletchley v1.

Kinakuta to help improve security.

Bletchley SDK

Longer range implications of Ethereum & other decentralising technologies (Consensys)

LOVED this presentation.

Simplest view: Next gen database. Blockchain based, maximal replication, Prevents rogue actors

Force for universal disintermediation, will distrupt every industry.

Previously it was mostly just Bitcoin. Future projects were "BitCoin 2.0", instead of "Blockchain 2.0".

So Ethereum project built the most powerful and capable Blockchain platform, both public (permisionless) and private (permissioned)

Deeply secure, non-repudiable shared source of truth.

Dapp is a set of smart contracts. And a user interface to interact with it.

Was important to get an initial version of Ethereum out into the hands of devs, to start thinking how to start building decentralised applications.

Ethereum has a vision for scalability, which includes sharding and state channels.

Privacy, state channels is one option. Zcash/zk-Snarks is another way.

Currently building out an ecosystem of decentralised applications.

Building core components: Identity/persona (uPort, metamask). Wallet (uPort wallet). Registries (Regis, ENS). Token Factory.

Do private enterprise Blockchains make sense? Yes, large entities can have a complex internal mix of business units, having a shared source of truth can help.

If enterprises have their own private consortium Blockchains, will be a harder target to infiltrate and modify databases.

Business processes emboided as state transition graphs.

If you plan on building your own tools or technology on top of Blockchain tech (public or private), build it on Ethereum so it can be reused in many different places by other entities running their private chains

Developed "Balance" for real time compliance, accounting auditing and monitoring. Real time dashboard for companies & regulators. Organisations using certified software wil not be able to break or bend any financial accounting rules.

The Blockchain will last for years or decades giving a persistent database. Gives a chance to do persistent portable identity. uPort self-sovereign identity.

Blockapps Announcement

Is Ethereum for Enterprise.

Partnered with Microsoft to announce Blockchain as a Service (BaaS). Over 1k projects have used it, over 300 customers.

Being released in Azure China datacentre (mooncake), and other Chinese clouds : Alibaba cloud, tencent cloud, Wancloud.

Initial China projects: Minsheng insurance, Wanxiang smart city, Qianhai smart city, Shanghai smart city.

China is going to be the country leading the world in Blockchain projects.

The Rise of Blockchain Consortia: Uniting the Banking World

One of the largest banks in Spain.

Banks are just a ledger (a very large ledger).

Each bank has its own ledger. They don't trust each others. Which is why you need clearing houses and things like this.

What if there was a shared ledger trusted by all banks. "It's not about the coin, its about the ledger.

New development of ChinaLedger: Forging a powerful tool for Chinese capital market in the FinTech era

Was literally the most centralised blockchain I have ever heard of. Please excuse me as I rant inline.

ChinaLedger is a consortium.

11 founders established it. Chinese financial institutions and Wanxiang labs.

"we created our own Blockchain and tools".

Will come up with their own custom software and implementation. Will create a whitepaper and create reference architecture.

Partners will use the network to do transactions.

Need facilities to be able to freeze or take over acounts, and get access to all data. A need to be able to halt or freeze a transaction or smart contract. A need to be able to halt or freeze a transaction or smart contract. and the facility to liquidate an account or smart conract or manually change the state of a smart contract

We need to be able to stop the trading of certain stocks. Let regulators control things.

Will be fully in control of the gas.

Wants to support 100k/s and 1 ms latency.

Then ironically says tries to say they are going to put privacy into this. "Everything will be encrypted and private. Except that CCP & regulators who will have ability to read everything". I'm SURE that won't be abused…

[caption id="attachment_3706" align="alignnone" width="625"] Blockchain, distributed ledger, privacy, encryption[/caption]

Blockchain, distributed ledger, privacy, encryption[/caption]

Re-imagining Global Payments (For business)

Banks make a LOT of money from bank wires. So they have no incentive to come up with anything better.

The person sending the money needs to give 26 pieces of information. Don't know when you'll get the money, what the rate will be.

About $20 to send, $20 to receive, plus lose a few percentage through the conversion.

Their solution (for business payments). Register for an account, can use online. No fees. Transparent FX rate. Can track the payment. Uses Bitcoin in the middle.

Before international calls used to call many $s per minute. Now with VoIP (Skype) you can do it for cents.

Same thing will happen to international money transfers.

Enabling Global P2P Cash Transfers with Abra (For consumer)

https://www.goabra.com/

http://www.coindesk.com/abra-remittance-app-us-launch/

Nowadays you can send an IM to anyone else in the world instantly for free. Why can't you do the same thing with money?

Can do it locally in some domestic markets, like paytm (india, WeChat pay (China), mpesa (Africa). But not for cross border transactions.

iOS & Android. Real digital cash wallet. Send & receive globally. No FX risk. Add cash via bank or in person.

As private as paper cash. Abra tellers earn $$ (as a percentage fee).

The wallet is stored locally on the phone. So you "physically" control it. (need to back up your private key).

Use an Abra teller (someone else using the app) to exchange buy/sell cash for digital cash. Anyone can be a teller. Tellers charge a fee. Teller & user rate each other.

When 2 people send money each other via Abra, happens instantly, . No FX volatility.

Awaking the Sleeping Giant: The Natural Resource Industry and the Blockchain

Note: The presentation was in English, but I thought it was extremely considerate that he had his slides translated into Chinese as well. Every slide had simultaneous English & Chinese descriptions so that the attendees using the live translation headsets could follow along easier. If I ever present in another country again, I'll try and plan ahead like he did. Was very thoughtful.

Why is BHP interested in the Blockchain?

They are the largest mining company in the world (natural resources mining, not Bitcoin mining. Hehe)

They are a global distributed organisation. So a distributed Blockchain

Project Rai Stones. Sample tracking of geological samples. They are highly valuable resources. Some of the wells cost $100M, and you only get 1 chance to take the sample. They currently only track the samples manually through emails & spreadsheets.

They are working with Consensys & Blockapps. Runs on Ethereum & IPFS, on top of Microsoft Azure.

1 node at BHP, 1 at their collaborator, 1 at their regulator.

3 roles in the business flow, BHP out in the field, the analysis team, and BHP corp.

They create/register a smart contract on the network for each sample.

When the person collects the sample, they go to the dashboard, click the checkboxes to say they acquired, that updates the smart contract.

They ship it off, so they put in the details of which analysis office it is being sent to, updates state from collected to shipped.

Analysis team can log in, see what samples are in transit to them to be analysed. They receive it, give it a unique Id based on their internal process.

They get trusted tracking of samples, and real time updates.

What if they could automatically operate machines, they could help avoid bad combinations of machines operating at the same time. Like a crane operating on an oil rig, when a helicopter is coming in.

Disable a piece of machinery if it is past its allowed usage before routine preventative maintenance. Disabled until it is tested, and certified as okay on the Blockchain.

Stop unqualified people from using a tool or vehicle.

Ore gets mined and put onto shipping freighters. Need to track Provenance, custodians, entire supply chain.

Need to give regulatory data to the regulators in each country the operate in. All the mines in the industry need to submit this public data to gov, it all gets aggregated, and disseminated. But it costs HEAPS to do this. What if they built a consortium chain. They can all publish the public data, ready to be analysed instantly by peers. Could make the entire industry more effienct and transparent by making the consortium not just for the 1 country, but a public one. Give a global transparent view of the entire industry.

Would help drop costs of compliance.

They started on Ethereum Mainnet & Testnet. Now they are seeing the emergence of many private chains. They will see the bridging between chains.

Seen that Ethereum plans on sharding (many chains). Forsees that there will be a global mesh of these Public & Private chains all supporting each other.

Cotricity – “a prosumer to business”- virtual energy market on the Ethereum blockchain (Consensys)

https://co-tricity.com

Energy meets Blockchain

Joint venture between Consensys & an energy company in Germany.

Energy sector is changing rapidly. Prosumer is someone with generative capacity (eg. Solar panels & battery storage).

Normal smart meter collects usage about production & consumption. Tracked on Ethereum. Matches up Prosumers to local community things like Schools. The local environmental and economic benefits of keeping it in the local community.

Mechanism design, "reverse game theory".

Goal is to effectiveise the energy market and reduce costs. Means creating incentives such that the optimal strategy for every participant results in the realisation of this goal.

e.g. Help to smooth out the peak in the morning, give a small reward for not using energy in the morning